DISCLAIMER: I am not a financial advisor. The observations and ideas below are my own and should be considered in conjunction with a qualified professional advisor.

This document describes a method of investing that has a high probability of generating a good return over a decade or more of time by ...

The strategy is a generalization of Dollar Cost Averaging that mimics the effects of Managed Asset Allocation without requiring the sale of any asset. What that means to you is that you get to "buy low and sell high" without having to "time the market" or "pick winning stocks".

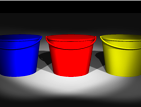

In a nutshell, the investor chooses a fixed percentage for stocks and a percent for bonds, e.g., 50% stocks and 50% bonds. Then shares of low-expense-ratio ETFs are purchased, e.g., IWV for stocks, and TIP for bonds. Periodically, e.g., every month, the value of the two "buckets" is compared. If the value of the stock-based shares are worth less than their chosen percentage, then stocks are bought, otherwise bond-backed shares are bought.

A discount broker like TradeKing is used so that the low five dollar commission is (for example) only 2.5% of a two hundred dollar purchase. This expense compares favorably to the four to five percent charged by most mutual funds. (Because shares are rarely sold, the commission for the sale is not significant.)

In reality, the bond part of the initial lump sum can be invested in real bonds, but ETFs are convenient for the periodic investment. (ETFs are Exchange Traded Funds; they're like mutual funds but they trade like stocks and often have lower fees, since they often passively track indexes. They are a convenient way for an individual investor to diversify an investment without paying more than one commission fee.)

I have read and would recommend the book, The Market Wizards: Interviews with Top Traders, by Jack D. Schwager. It makes a good case for the idea that a remarkable individual can overcome his or her own natural tendencies in order to follow an original strategy for buying and selling stocks or derivatives in order to "beat the market".

The reason these successful speculators need to overcome their natural tendencies is repeated throughout the book: We tend to sell when we are afraid, and we're afraid when the value of our investments is down. We tend to buy when we are not afraid but are excited by and greedy for profit, and that's when the value of our investments are high. But behaving like that is buying high and selling low—a recipe for disaster!

There are also the natural tendencies to procrastinate, to avoid deep reflection, to act hastily or to fail to act, etc.

These investors often stress that speculating is not possible for most personalities. Even with a workable strategy, sticking with it is psychologically and technically very difficult. Several of the successful wizards in the book lost all of their money one or more times.

The human tendencies mentioned above are weaknesses when it comes to investing. Financial professionals point them out and offer an expensive alternative when they offer to look after your money in return for their own income.

But regular periodic investments of a fixed sum are easy, especially when they are mildly interesting and fun to do, as they are in the Buy-Only Rebalancing system, where you get to fill up the bucket with the lowest level, knowing that doing so works in bear and bull markets.