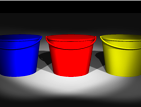

Here we discuss the buckets into which you put your funds. Conceptually, you can think, e.g., "sixty percent of my money goes into the stocks bucket, thirty-five percent goes into the bonds bucket, and five percent goes into the cash bucket."

Generally, higher profits are only attainable by the assumption of risk. Insurance companies assume risk in order to get paid by the insured. Investors assume risk to benefit from the explosive growth of a successful startup business or to get higher interest rates by buying bonds from companies with shaky financials.

In the Buy-Only Rebalancing system, an investor chooses a target allocation of funds in order to balance risk and profit. Over time, more risky investments might be more profitable, but if there is not much time, risk should be minimized.

Concretely, what that means is if you might need the money soon, it should be invested in something with almost no risk. Examples are shares of TIP or SHY, which will only fail if the United States government does. (Astute readers might object that ETFs are managed by people who can make mistakes that introduce risk beyond that of the underlying investment. That's true. Real U.S. Treasury securities would be even less risky than shares of the ETFs that hold them.)

If, on the other hand, you won't need the money any time in the next hundred years, something like SAA might be a good idea, since its aggressiveness will have time to work to your advantage, and if the share price is way down for a month or a decade, it won't bother you.

When choosing the percentages for the buckets initially, consider how much time you have before you'll need the money. I tend to be very conservative compared to most professional financial advisors I've talked to, and I figure I want to keep this money invested for at least thirty years, so I like a half-stocks, half-bonds allocation.

To increase risk and profit potential, one might increase the stock allocation to 60 percent or more.

An interesting twist is that each bucket can contain other sub-buckets! For example, inside your bonds allocation, you have another decision to make: What percentage should be backed by the U.S. Treasury (like SHY), inflation protected (like TIP), backed by federal-tax-free municipal bonds (like PZA), or backed by triple-A rated corporate bonds, which are taxable but have a higher return (like LQD)?

Every month the investor makes a purchase with the same number of dollars. Really it can be any fixed time period, not just a month. This periodic investment eliminates the temptation to time the market that can be so costly, and because the dollar amount invested is always the same, more shares are bought when the price is low than when the price is high. This is the key insight of dollar cost averaging.

The major objection to dollar cost averaging is the broker commission fee charged when the purchase is made. These objections seem to be made by people who are not using discount brokers. A fixed $5 commission is not a high overhead for an purchase of a hundred dollars or more, at least not when compared to the advantages this strategy offers. (You'd buy yourself a five dollar magazine every month, right? So forget about it!)

For example, say in April you made a very simple initial "lump-sum" investment of $1000 in IWV for your stocks bucket and another $1000 in PZA for your bonds bucket, a fifty-fifty allocation. You have decided to invest $200 every month.

In May, you go to your broker and examine the value of your holdings. You see that the stock market has tanked, and so your IWV is worth only $500, while your PZA didn't go down as much. It is now worth $850. Sticking with the plan, you buy $200 worth of IWV to fill the bucket that is not as full as it is supposed to be, the stocks bucket. You are buying stock at a relatively low price.

In June, the stock market has fully recovered! You find that your IWV shares are now worth $1400, and your PZA is back at $1000. To move the buckets toward your fifty-fifty target allocations, you buy PZA.

If you think about it, in behaving like this over the long term the effect is the same as if you had been selling shares from the too-full bucket in order to buy shares in the too-empty bucket, except that you have avoided paying a sales commission or any capital gains tax on the rebalancing.

Many 401(k) investment plans include a "Life Cycle Fund" option. These are managed allocation funds that ask you how old you are and when you plan to retire. They start out with an allocation target that is aggressive, when you have lots of time before retirement, and they rebalance the allocation as you get closer to retirement, lessening the risky investments and increasing the amount you have in low-risk investments. The idea is that you'll retire with a guaranteed income.

You can do the same thing in the Buy-Only Rebalancing system by adjusting your target percentages as you age. By making small adjustments, you can avoid the exposure to short-term market conditions that would occur if you jumped suddenly, artificially causing you to buy only one bucket for several consecutive periods.